Weekly Market Commentary | November 25th, 2024

Week in Review…

Markets rallied last week as investors digested positive economic data and election results. The major indices all reached new record highs:

- The S&P 500 rose +1.68%

- The Dow Jones Industrial Average was up +1.96%

- The tech-heavy Nasdaq finished up +1.73%

- The 10-Year Treasury yield ended the week at 4.412%

A Quiet Week Ahead of the Holidays

Last week was relatively quiet as the market geared up for the holiday season. Despite the slower pace, several key reports provided important insights into the economy.

Mixed Signals in the Housing Market

The housing market presented a mixed picture. While existing home sales exceeded expectations, rising month-over-month (MoM) by 3.4%, new home construction showed signs of weakness. Building permits and housing starts underperformed, with the latter declining by 3.1% MoM. This suggests that while buyers are willing to purchase available homes, builders may be hesitant to start new projects due to rising long-term interest rates.

Consumer Sentiment Remains Cautious

The University of Michigan’s consumer sentiment index and inflation expectations surveys offered further insights into consumer attitudes. While consumers’ inflation expectations align with consensus forecasts, their overall sentiment remains cautious. Both consumer sentiment and inflation expectations came in lower than expected, indicating continued uncertainty about the economy’s trajectory.

Spotlight

Tax Strategies Unveiled: Understanding 1031 Exchanges Versus Qualified Opportunity Zones

For decades, investors have utilized Internal Revenue Code (IRC) Section 1031 to defer capital gains on investment property sales through like-kind exchanges. The Qualified Opportunity Zone (QOZ) program, established by the Tax Cuts and Jobs Act of 2017, offers an alternative method to postpone and potentially eliminate certain taxable gains. This spotlight examines key characteristics and investment considerations for these two programs without delving into their mechanics.

1031 Exchanges

The 1031 exchange, named after its section in the Internal Revenue Code, involves selling and buying similar types of investment properties of equal or greater value. If the exchanged property involves leverage, the replacement property must have equal or greater leverage to avoid triggering taxable events. Key aspects of 1031 exchanges include:

- A 45-day identification period for the new asset after the original asset’s sale

- A 180-day acquisition period for the replacement property

- Potential combination with other tax benefits, such as depreciation. When exchanging properties, the cost basis of the new property is reduced by previously claimed depreciation on the original property, allowing continued depreciation claims on the new property.

- Indefinite tax deferral through repeated exchanges, unless a 721-tax deferral option is used to UPREIT the DST interests into a REIT

IRC Section 1031 does not permit exchanges for primary residences. Instead, IRC Section 121 addresses the homebuyer exclusion limits.

Qualified Opportunity Zone Funds

Qualified Opportunity Zone (QOZ) Funds offer tax benefits for investors with capital gains, including:

- Capital gains tax deferral

- Potential reduction of the original deferred gain (if the investment is held for at least five years)

- Tax-free appreciation on the QOZ Fund investment if held for at least 10 years

Unlike 1031 exchanges, only the gain needs to be invested in a QOZ Fund within 180 days of sale to defer taxes, and the investment can be from any appreciated asset. QOZ Funds must adhere to specific guidelines, including:

- Investing only in QOZ-specific census tracts designated by the U.S. Treasury

- Holding at least 90% of assets in QOZ property

- Deriving at least 50% of gross income from active conduct of business in the QOZ

- Using a substantial portion of intangible property in active business conduct in the QOZ

- Having less than 5% of assets in nonqualified financial property

Deferred gains invested in QOZ Funds become taxable on December 31, 2026, or when the investment is sold, whichever comes first. Investors who hold their QOZ Fund investment for at least five years can permanently reduce their tax liability on the original deferred gain by 10%.

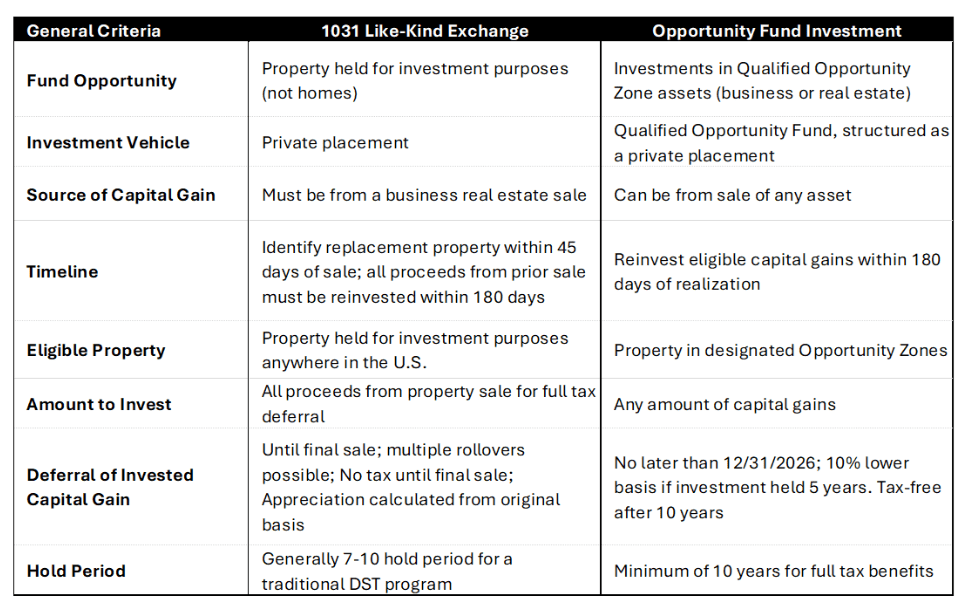

Comparing the Two

The key difference between 1031 exchange and QOZ programs lies in their tax deferral structures. Non-721 (pure) 1031 exchanges offer unlimited tax deferral, while QOZs have a limited deferral period but provide tax-free profits after a 10-year hold.

For those aiming to defer taxes indefinitely without accessing investment capital, non-721 1031 exchanges are preferable. They can be valuable estate planning tools, as heirs receive a stepped-up basis to the property’s fair market value at death, erasing previous appreciation.

QOZs are better for investors planning to realize profits within their lifetime. However, taxes on the original investment are due on December 31, 2026, regardless of circumstances.

Risks

Both 1031 exchanges and Qualified Opportunity Zones (QOZs) carry significant risks.

For 1031 exchanges, these include strict timelines, adherence to the ‘seven deadly sins,’ potential overpayment for replacement properties, and market volatility. QOZs face risks such as regulatory changes, economic uncertainties in designated zones, and the requirement to pay deferred taxes by December 31, 2026.

Both strategies involve illiquidity and the potential for investment losses that are inherent in any private real estate transaction, and sponsor/manager risk for syndicated private placement programs.

Optimal Choice

The optimal choice between these strategies hinges on each investor’s specific financial objectives and tax planning considerations. Depending on a client’s unique circumstances, both approaches can be effectively utilized, either independently or in combination, to maximize overall financial benefits.

IMPORTANT DISCLOSURE

This content is presented for informational purposes and is not an exhaustive list of all considerations related to 1031 exchange and qualified opportunity zone investments. The information presented was not prepared in connection with any specific offering or based on the individual needs of any one investor but rather for general educational purposes. This communication shall not constitute an offer to sell or the solicitation of an offer to buy securities. 1031 Exchange and Qualified Opportunity Zone investments are intended only for persons who are accredited investors. We make no representation or warranty of any kind with respect to the acceptance by the IRS or any state taxing authority of your treatment of any item on your tax return or the tax consequences.

There is no guarantee that any real estate strategy, including those described herein, will be successful. An investment in a real estate investment offering is speculative and involves significant risks including but not limited to: no secondary market for the securities; limited liquidity for the securities, limitations on the transfer and redemption of shares; distributions made may not come from income, could be subject to Board discretion, not guaranteed and can be deemed a return of capital – there can be no limits on the amounts paid from these other sources; the investment may lack property diversification; the Sponsor and Trustee are generally dependent upon the advisor to select investments and conduct operations; and the advisor will face conflicts of interest. Investments are not bank guaranteed, not FDIC insured and may lose value.

Week Ahead…

A Busy Week for Economic Data

Despite the Thanksgiving holiday shortening the week, several important economic reports are scheduled to be released. These reports will provide valuable insights into the current state of the U.S. economy and could influence market sentiment.

Treasury Auctions and Yield Curve

On Monday and Tuesday, the Treasury Department will auction off 2-year and 5-year Treasury notes. The 2-year note is particularly significant as it’s highly sensitive to interest rate policy decisions and reflects market expectations for short-term rates. The yield curve, often measured by the difference between the 10-year and 2-year yields, is a key indicator of economic health. An inverted yield curve, where the 2-year yield exceeds the 10-year yield, can signal an impending recession.

Consumer Strength and Housing Market

Tuesday will also bring data on new home sales and consumer confidence. New home sales will reveal how consumers have navigated rising mortgage rates in October, which started the month at 6.12% and ended at 6.72%. Consumer confidence is a crucial indicator as consumer spending accounts for approximately 68% of U.S. GDP in Q2 2024.

GDP and Inflation

On Wednesday, the Bureau of Economic Analysis will release the annualized quarter-over-quarter change in real gross domestic product (GDP), a measure of economic growth. Additionally, the Core Personal Consumption Expenditures (PCE) Price Index, a key inflation indicator, will be released. Current projections point to a 0.3% month-over-month increase and a 2.7% year-over-year increase.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.