Weekly Market Commentary

April 14th, 2025

Week in Review…

Market indexes continued to experience significant volatility as investors adjusted their future expectations in response to increasing global trade tensions.

- The S&P 500 rose by 5.70%

- The Dow Jones Industrial Average increased by 4.95%

- The tech-heavy Nasdaq rose by 7.43%

- The 10-Year Treasury yield closed at 4.49%

Last week was filled with significant economic releases that provided a comprehensive view of the current economic landscape. On Monday, the change in the total value of outstanding consumer credit from the previous month increased by $81 million, indicating a bearish economy. On Tuesday, the American Petroleum Institute reported that U.S. crude oil inventories fell by 1.057 million barrels for the week ending April 4, after a 6.037 million barrel spike the previous week.

The Federal Open Market Committee (FOMC) meeting minutes were published on Wednesday, offering a detailed account of the discussions and decisions made during the latest policy meeting. On Thursday, the initial jobless claims and Core Consumer Price Index (CPI) data were released. The Core CPI for March rose 2.8% on an annual basis, lower than the forecasted 3% change. Additionally, the labor market showed signs of cooling with continuing jobless claims coming in below forecast at 1,850 claims and initial jobless claims coming in as anticipated with 223,000 claims for the week.

Finally, on Friday, the Core Producer Price Index (PPI) and Michigan Consumer Expectations were released. The Core PPI for the month of March fell by 0.1%, indicating a potential decrease in the price of goods and services. Furthermore, consumer sentiment fell sharply in April, marking the fourth consecutive month of declines, with the University of Michigan’s consumer sentiment index dropping to 50.8.

Spotlight

Private Credit: Navigating Sponsored and Non-sponsored Lending

Private credit markets are experiencing substantial growth, providing investors with an expanding range of opportunities amid a decline in bank lending and evolving risk dynamics. According to Morgan Stanley, the private credit market was valued at approximately $1.5 trillion at the beginning of 2024, up from around $1 trillion in 2020, and it is projected to reach $2.8 trillion by 2028.

However, with opportunity comes complexity. Navigating these markets demands experienced managers, disciplined investors, and a deep understanding of risk. Those considering investments in private markets should prioritize managers who have effectively weathered multiple credit cycles.

Within private credit strategies, managers typically concentrate on either sponsor-backed lending or non-sponsor-backed lending. As private credit grows to become a larger part of investors’ portfolios, distinguishing between the various strategies becomes increasingly crucial.

Sponsor-backed private credit

Sponsor-backed private credit refers to financing arranged by private equity firms, or sponsors, to acquire companies or support the objectives of portfolio companies. In these arrangements, the private equity firm selects the target company for investment. Lenders involved in sponsor-backed transactions often focus heavily on the track record and reputation of the private equity sponsor, in addition to assessing the creditworthiness of the underlying borrower. Notably, sponsor-backed financing generally comes with more flexible terms, placing fewer restrictions on the borrower and allowing greater leniency regarding financial performance metrics. This type of structure is commonly referred to as “covenant-lite” in the private credit sector.

Non-sponsor-backed private credit

Private credit that isn’t backed by sponsors involves financing arrangements made directly between borrowers and lenders. In these transactions, the absence of private equity backing means that lenders must independently source deals and maintain a steady pipeline, along with strong underwriting capabilities and operational expertise. Additionally, these agreements typically come with more stringent covenants designed to better safeguard investors’ interests.

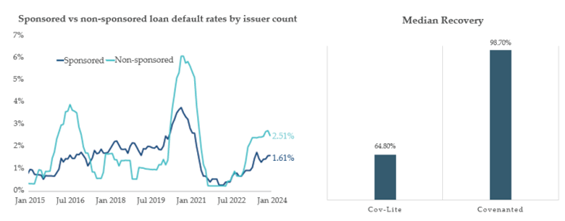

A study by S&P Global examined loans originated between 2014 and 2H 2020 and revealed that the median recovery rate for covenant-lite loans was 64.8%, compared to 98.7% for fully covenanted loans. This discrepancy highlights that, while loans with stricter covenants may experience more frequent defaults, they provide a better framework for protecting principal investments from losses resulting from those defaults.

Sources: PitchBook | LCD. “Private Credit & Middle Market Quarterly Wrap.” 1Q 2024.

S&P Global, “Settling For Less: Covenant-Lite Loans Have Lower Recoveries, Higher Event And Pricing Risks.” October, 13, 2020.

(click image to expand)

As the private credit asset class continues to expand and mature, it’s important for investors to recognize the various nuances that come with the different types of private credit. Financing that is sponsor-backed versus non-sponsored requires distinct managerial expertise to effectively implement the strategy. Investors should not only pay attention to the specific investment approach but also place greater emphasis on selecting the right managers.

Week Ahead…

The market will be closed on Friday to observe Good Friday, making it a short week with limited economic data releases.

On Wednesday, we will receive the retail sales data, which is a crucial indicator of consumer spending. Consumer spending accounts for a significant portion of economic activity, making retail sales data an important measure of the economy’s health. This data helps investors and policymakers gauge potential inflationary pressures and adjust their strategies accordingly.

Also on Wednesday, Fed Chair Jerome Powell will deliver a speech. This event is particularly important due to the recent market volatility in both equity and bond markets stemming from the ongoing trade war. Investors will be closely monitoring Powell’s remarks for insights into the Federal Reserve’s future monetary policy and its approach to managing economic uncertainties. The verbiage Powell uses can significantly influence market sentiment and expectations regarding interest rates and economic stability.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.

An alternative investments strategy is subject to a number of risks and is not suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risk associated with such an investment. Certain risks may include but are not limited to the following: loss of all or a substantial portion of the investment, short selling or other speculative practices, lack of liquidity, volatility of returns, absence of information regarding valuations and pricing, complex tax structures and delays in tax reporting.

Securities offered through Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC, and investment advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Both are wholly-owned subsidiaries of Cambridge Investment Group, Inc. V.CIR.0425-1490