In this week’s recap: Stocks stall late in the week, thanks to tech markets slide. The jobs recovery makes continued progress.

Weekly Economic Update

Presented by Bob Polley September 7, 2020

THE WEEK ON WALL STREET

A late week sell-off sent stocks broadly lower as investors took some profits after stocks reached all-time highs earlier in the week.

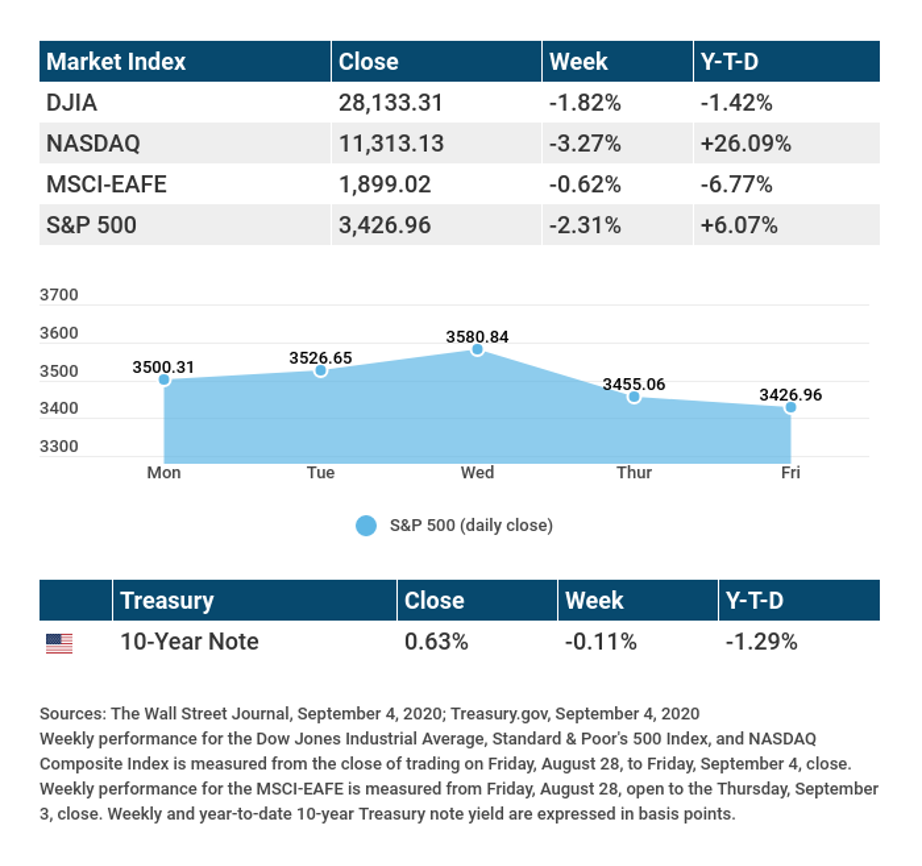

The Dow Jones Industrial Average slid 1.82%, while the Standard & Poor’s 500 slumped 2.31%. The Nasdaq Composite index dropped 3.27% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, fell 0.62%.1-3

Gravity Reasserts Itself

Stocks hit a wall late last week as the technology companies, which had led the market higher, slipped in Thursday and Friday trading, dragging down the overall market.

The week began on an upbeat note as August momentum continued into the start of September. While participation in the rally on Tuesday and Wednesday was fairly broad, technology stocks continued to be the focus of market strength. But that sentiment changed quickly on Thursday.

With little warning and no obvious catalyst, it remains unclear whether the technology selloff last week was the result of market technicals or a fundamental change in investor outlook. The coming weeks may provide some clarity in this regard.

Labor Market Recovery Sputters Forward

Last week saw a series of employment-related reports that evidenced a continued labor market recovery.

The Automated Data Processing (ADP) employment survey showed that private payrolls increased by 428,000 in August, falling short of consensus expectations of over 1.1 million. News turned more positive as new jobless claims checked in at 881,000—an improvement from the over one million new claims the prior week. Americans receiving unemployment declined by 1.24 million to 13.3 million—half the peak number in May.4,5,6

Finally, the monthly jobs report indicated that nearly 1.4 million nonfarm jobs were added last month, with the unemployment rate declining to 8.4%. The progress was predominantly attributable to government hiring, primarily of new Census workers, though the retail, leisure and hospitality sectors saw gains in new hiring.7

T I P O F T H E W E E K

Sometimes teens confuse wants with needs. Pointing out the difference will help them handle money with more maturity (and it may help you save a dollar or two).

THE WEEK AHEAD: KEY ECONOMIC DATA

Wednesday: Job Openings and Turnover Survey (JOLTS).

Thursday: Jobless Claims.

Friday: Consumer Price Index (CPI).

Source: Econoday, September 4, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: Lululemon (LULU), Coupa Software (COUP), Slack Technologies (WORK).

Thursday: Chewy (CHWY), Peloton (PTON).

Friday: Kroger (KR).

Source: Zacks, September 4, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Q U O T E O F T H E W E E K

“Laughter is by definition healthy.”

DORIS LESSING

T H E W E E K L Y R I D D L E

If it were two hours later than right now, it would be half as long until midnight as it would be if it were an hour later than right now. What time is it?

LAST WEEK’S RIDDLE: There is a kind of sweet bean that never grows in a garden. What is it?

ANSWER: Jelly Bean.

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the Nasdaq stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2020 FMG Suite.

CITATIONS:

- The Wall Street Journal, September 4, 2020

2. The Wall Street Journal, September 4, 2020

3. The Wall Street Journal, September 4, 2020

4. CNBC, September 2, 2020

5. CNBC, September 3, 2020

6. CNBC, September 3, 2020

7. CNBC, September 4, 2020

CHART CITATIONS:

The Wall Street Journal, September 4, 2020

The Wall Street Journal, September 4, 2020

treasury.gov, September 4, 2020

Polley Financial Group

4500 South Lakeshore Drive, Suite 300

Tempe, Arizona 85282

Phone: 480-921-7706

Fax: 877-577-7706